What Are Typical Property Management Fees in San Antonio: What Sort of Value Should Your Managers Provide?

Successful real estate investors recognize that employing a good property manager is more of an asset than an expense. The best property managers help to maintain rental property occupancy year after year, enhance return on investment, and free up your valuable time so you can focus on building your real estate business.

However, when engaging a property management company for your rental property in San Antonio, it is critical to consider the entire cost. On average, most property management companies in San Antonio impose a monthly fee ranging from 8% to 12% of the monthly rent collected.

Keep reading to learn more about hiring a property management company in San Antonio and the various fees attached to getting one.

Table of Contents

The Real Value of Property Managers

Pricing Varies Depending on Many Factors

What Do Typical Property Management Fees Include in San Antonio?

2. Monthly Management Fee

3. Repairs and Maintenance Fees

4. Tenant Placement Fee

5. Vacancy Fee

6. Eviction Fee

7. Early Termination Fee

8. Routine Inspection Fees

Final Thoughts on Property Management Company Fees in San Antonio

The Real Value of Property Managers

Before deciding whether to self-manage or engage a property manager, you need to grasp the process of managing rental properties. A first-time investor may consider a rental property as a simple equation: rental revenue minus (mortgage + costs) equals profit.

While there is nothing wrong with attempting to self-manage a rental property, you must also factor in the landlord duties, physical and financial costs to determine how much time it actually takes.

Hiring a competent property manager will save you the stress of learning about the local real estate market, fair housing laws, and habitability regulations. You will also not have to bother with tenant screening, marketing, vacancy-related issues, and even rent collection.

In addition, managing routine and emergency maintenance is part of owning a rental property. Hiring a property manager will assist you in handling scheduled seasonal maintenance to keep appliances operational, gutters from overflowing, and tenant check-ins.

Also, you’re less likely to deal with late night tenant complaints or emergency maintenance requests from your tenants. More importantly, hiring a qualified property manager can protect your investment due to their skills, training, and experience, thereby ensuring that your property meets, or even exceeds, your investment goals.

Choosing to work with a property management company in San Antonio like Bluebonnet Property Management comes with a lot of financial and physical values. Not only do you get to save money, you are assured of expert service. Reach out to us today to get started.

Pricing Varies Depending on Many Factors

The price you pay in property management fees is determined by the amount of work required by the property management company to keep your property in good condition and maximize rental income and value. A modest multifamily structure with three or four units, for example, is more labor-intensive for a property management than a single-family rental home.

The following factors influence a landlord's property management fee:

- Property type: Such as a single-family rental versus a multifamily complex versus a short-term rental property. Managing a larger property or number of units requires more resources. Therefore, fees may be higher. However, keep in mind that you can also pay lower fees for renting more properties with the manager.

- Property size: Multifamily investment properties with larger total square footage per property demand more work, and thus tend to draw higher costs than smaller single-family investment properties.

- Property condition: Even if properly maintained, older properties typically require more repairs and maintenance than modern residences.

- Neighborhood rating: In general, neighborhoods with higher ratings will attract better tenants and have less problems than regions with poor school systems and few amenities.

- Full-service vs. a la carte pricing: Some property management businesses charge a lower monthly fee for basic services like rent collection and maintenance requests, but then offer landlords a la carte or pay-as-you-go pricing for repair bills, property inspections, and lease renewals.

- Market competitiveness: Current market competition may influence property management prices as well, with property management fees in some smaller markets being higher due to fewer competition and options for landlords.

What Do Typical Property Management Fees Include in San Antonio?

For a fee, landlords can hire a property management company to help them manage their rental property. Property management fees will differ depending on a number of criteria, including the type of property and the services provided. The following is a list of the fees that a property management company in San Antonio may charge.

1.

Initial Setup Fee

A property management company may charge an upfront setup fee to create your account with them. However, not all property management companies in San Antonio require an initial setup fee, and if they do, it is usually minimal. This charge may also include:

- Creating your account for bookkeeping purposes

- Opening a bank account in your name if needed

- Assisting with applying for any required business or tax licenses

- Initial property inspection

- Coordinating the transition to a new property management company if you purchased a turnkey rental property

2. Monthly Management Fee

Most property management companies charge a monthly fee to manage a property. Typically, the contract you sign with the property manager will define how this cost is computed and what services are included.

Some organizations have a larger monthly management price, but it may be more inclusive, so don't be scared off by a greater initial fee until you understand what is included.

A property manager may charge a flat fee or a percentage of the rent to manage your property:

Flat Fee

A flat fee is a set sum of money paid to the property manager each month. The precise figure is decided by the size or square footage of the property as well as the services provided. A single-family property, for example, might have a monthly flat fee of $150.

Percentage of Rent

Typically, most property management companies will charge a percentage of the monthly rent compared to a flat fee. While the amount collected may vary, it is often between 8% and 12% of the gross monthly rent.

In areas like San Antonio, it is common for property managers to typically charge a lesser percentage, ranging from 4% to 7%, for properties with ten or more units or commercial properties. For smaller or residential properties, a larger percentage fee of 10% or more is customary.

For example, a 5% monthly fee would be $2,500 for a property with $50,000 in monthly rent, whereas a 5% monthly cost for a property with $2,000 in monthly rent would be $100.

3. Repairs and Maintenance Fees

Maintenance fees are frequently included in the monthly management charge. This could entail cleaning communal areas, removing debris, and raking leaves.

If a specific repair is required, the cost will be withdrawn from the reserve repair fund, which is a separate account in which the landlord keeps money for property repairs. There are several options for managing the account and handling the repair process.

4. Tenant Placement Fee

A property manager may charge an additional fee for placing tenants in your home. This could be a one-time fee or a percentage of the rent. It is normal to pay half a month's rent to a full month's rent.

The tenant placement charge may cover advertising costs, tenant screening, move-in procedures, and lease agreement preparation. This fee may be repaid to the property manager if the tenant breaks their lease early or is evicted, depending on the contract terms.

5. Vacancy Fee

Although not all firms will charge a vacancy fee, there is a lot of labor involved in managing your home even if it is vacant. As a result, you may be obliged to pay a separate cost, or you may be required to continue paying the management fee.

Your manager will need to check on the vacant property, look for plumbing problems, and do storm inspections. Because there is no renter to report these issues, the property requires special attention when vacant.

This could be a one-time price of one month's rent, or it could be a fee per vacant apartment, such as $50 per unit.

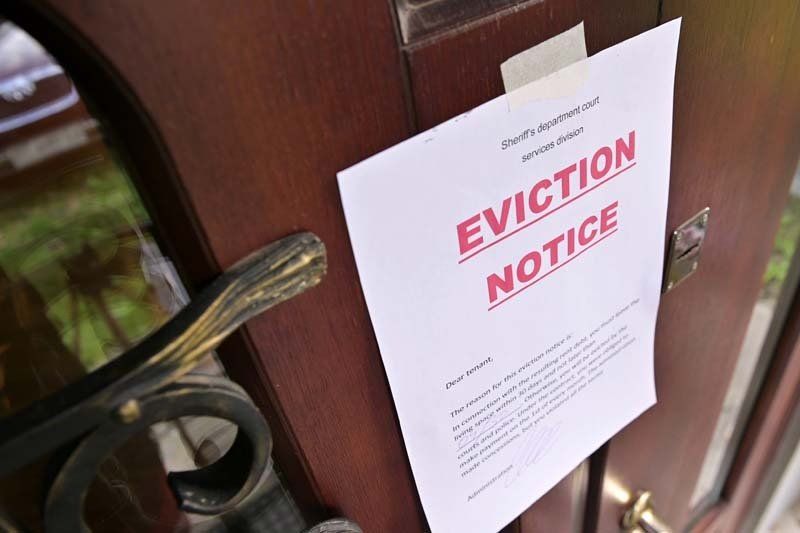

6. Eviction Fee

Although this doesn’t happen often, there may come a moment when you must evict a tenant for nonpayment of rent, causing recurrent disruption in the area, or ruining your rental property. If you want a property manager to handle tenant evictions, you will have to pay for it.

While established property management companies may have the expertise to conduct evictions on their own, others would hire a local legal company that specializes in residential evictions to perform the process. Expect to pay a hundreds of dollars in eviction fees plus any relevant legal fees.

And when your eviction case is heard in court and you receive a judgment, collections companies and attorneys often charge a collection fee of approximately 50% of the money collected.

7. Early Termination Fee

Unless the landlord breaches the property management contract "for cause," such as the manager failing to perform as promised, ending the property management agreement early will normally result in an early contract termination charge. Termination costs can vary greatly and can range from one month's lost income to the tenent being sued for breach of contract.

8. Routine Inspection Fees

A residential rental property should be inspected inside and out every three to six months as a rule of thumb. Routine inspections help to catch and solve minor issues before they become major and expensive issues, as well as to ensure that the renter is not causing damage to the property.

Some property management companies will perform a free semi-annual inspection. Others could request that you pay for each inspection in exchange for a lower monthly property management cost.

In either scenario, request that the property management business offer you a full inspection report, as well as images or videos, to demonstrate that routine inspections are performed.

Final Thoughts on Property Management Company Fees in San Antonio

Hiring a property manager can alleviate a variety of problems, but it is critical to choose the ideal company or individual for your property management needs. The right experience, technology, customer service, and a reasonable property management firm cost structure all contribute to how confident you are in your decision.

So, keep the aforementioned criterion in mind while you search, and if you're looking for a property management professional in your area, look no further than Bluebonnet Property Management Group.

We provide superior property management services in Texas to help you enhance your ROI by optimizing rental rates while minimizing expenditures with affordable management fees and no hidden costs!