The Dos and Don'ts of Managing a Rental Property During a Recession

Managing a rental property can be challenging at the best of times. Still, during a recession, it can be downright daunting. As the economy experiences a downturn, tenants may struggle to pay rent, and landlords may find it challenging to fill vacancies. In fact, according to a report from the Joint Center for Housing Studies of Harvard University, during the 2008-2009 recession, the number of renter households with severe housing cost burdens increased by 3.6 million, an increase of 29 percent.

However, despite the challenges, owning and

managing a rental property during a recession can also present unique opportunities for savvy landlords. By taking a proactive approach and following some essential dos and don'ts, landlords can not only weather the storm but also position themselves for success in the long run.

Don’t Make The Mistake of Selling Your Rental Property During a Recession

Selling your rental property during a recession may seem like a tempting option, especially if you're feeling financial strain. However, it's essential to weigh the pros and cons before making a hasty decision.

In many cases, selling during a recession could actually be a mistake.

One of the main reasons is that property values tend to drop during economic downturns. According to

Federal Reserve Economic Data, during the Great Recession, home values in the U.S. fell by 17.3% from their peak in 2007 to their low in 2011.

That means that if you

sell your rental property during a recession, you're likely to receive less money than you would during a more stable economic period.

Furthermore, selling a rental property during a recession could also mean missing out on potential long-term gains. Real estate is a long-term investment, and values tend to appreciate over time. By selling during a recession, you may be sacrificing future growth potential.

So, it's essential to consider the long-term implications before making any decisions. If you're struggling financially, other options may be available, such as refinancing or adjusting your rental rates.

So, before you put that "For Sale" sign up, take a deep breath, crunch the numbers, and consider all of your options. You never know; the recession may end up being just a blip on the radar in the grand scheme of things.

10 Ways To Manage Your Rental Property in Recession

During a recession, managing a rental property can become more challenging as tenants may struggle to pay rent or may move out, leaving the property vacant. We will discuss 10 tips for managing your rental property during a recession, including strategies for reducing expenses, finding new tenants, and communicating with current tenants.

1. Retain Current Tenants

Retaining tenants during a recession requires understanding and empathy. As Winston Churchill said, "The pessimist sees difficulty in every opportunity. The optimist sees opportunity in every difficulty." By approaching the recession with a positive attitude and taking steps to retain your tenants, you can come out on top in the long run.

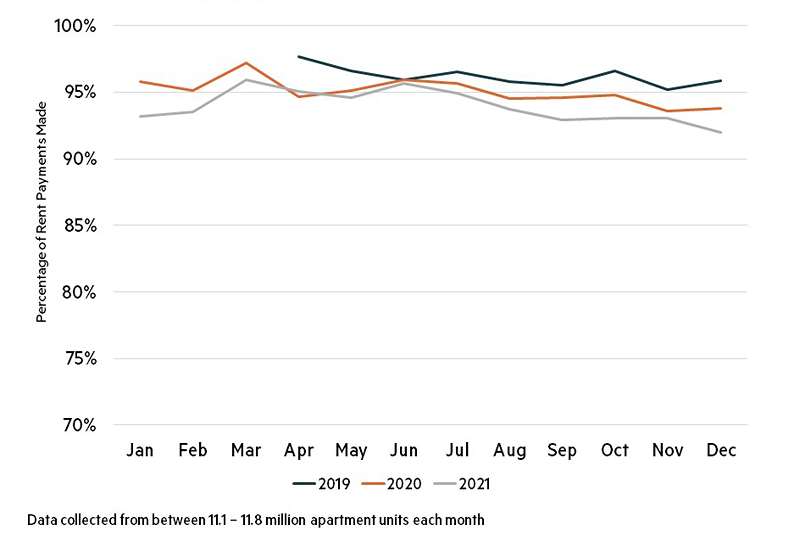

A survey by the National Multifamily Housing Council showed that many renters are still making an effort to pay rent despite economic hardship. By taking steps to show their tenants that they value their business and want to help them through difficult times, landlords can increase tenant loyalty and retention.

2. Make Extended Lease Arrangements

Extended lease arrangements are agreements between landlords and tenants that allow for a longer rental period, typically beyond the standard 12-month lease. These arrangements can be beneficial for both parties during a recession, as they provide stability and predictability for tenants and landlords alike.

- For tenants, extended leases can offer greater security during uncertain economic times, as they provide a longer-term commitment from the landlord. This can help alleviate concerns about rent increases or the possibility of being forced to move due to economic hardship.

- For landlords, extended leases can provide a reliable source of income for a longer period, reducing the risk of vacancies or having to search for new tenants during a recession.

By offering extended lease arrangements, landlords can provide tenants with greater stability and security, while also ensuring a consistent stream of rental income during challenging economic times.

3. Be Flexible With Rent Payments

Being flexible with rental payments during a recession can be crucial for both landlords and tenants. Tenants may experience financial difficulties and struggle to pay rent, while landlords still need to cover their expenses. By being flexible, landlords can help their tenants stay afloat while ensuring they receive some income.

According to a survey by the National Multifamily Housing Council, 81% of renters made full or partial rent payments in the first week of April 2020, indicating that many tenants were facing financial hardship due to the pandemic.

Offering flexibility, such as payment plans or rent deferrals, can help alleviate some of the financial burdens and ensure that tenants don't fall behind on payments.

4. Structure Leases Thoughtfully

When it comes to structuring leases during a recession, it pays to think ahead and avoid common pitfalls. For example, if you're renting near a university, steer clear of leases that end in the middle of a school year.

Similarly, winter months are typically associated with a higher rate of rental vacancies, as many people prefer to move during the spring and summer months. So, take note of these leases and make due preparations. Trust us, you don't want to be left twiddling your thumbs in an empty apartment in the dead of winter.

Consider extending your leases to 16 months or scheduling them to end in the springtime, when the tenants are more likely to stick around. And if a prospective tenant isn't keen on a longer lease, don't sweat it—just move on to the next one who's ready to settle in for the long haul.

By taking a thoughtful approach to lease structuring, you can keep your properties occupied, your tenants happy, and your pockets lined even in the middle of a recession.

5. Invest in the Upgrades

Investing in property upgrades during a recession can be a smart move for landlords. Upgrades can make your property more attractive to potential tenants, increase its value, and even lower your maintenance costs in the long run. By showing that you're willing to invest in your property, you can demonstrate to tenants that you're committed to providing a high-quality living experience.

Plus, who doesn't love a good upgrade? Whether it's a fresh coat of paint, new appliances, or a snazzy new backsplash, investing in your property can make it feel like a home—and that's something that tenants will always appreciate.

6. Communicate With Your Tenants

Effective communication with tenants during a recession can be a game-changer for landlords. By keeping tenants in the loop about any changes or challenges, landlords can build trust, maintain a positive relationship, and even identify areas for improvement.

Communicating with tenants has been one of the top priorities for landlords during the COVID-19 pandemic. This included regular updates on health and safety measures, rent policies, and maintenance issues.

Plus, communication doesn't have to be boring—think outside the box and get creative with newsletters, social media, or even a friendly chat over a cup of coffee. By showing that you're willing to go the extra mile to connect with your tenants, you can build a loyal community that will stick with you through thick and thin.

8. Think of Alternative Uses for the Property

During a recession, landlords can explore alternative uses for their rental property to generate additional income. Here are some ways to make the most of your property:

- Short-term Rentals: Consider listing your property on platforms like Airbnb or VRBO to attract travelers or people in need of temporary housing.

- Co-living: Transform your property into a shared living space for multiple tenants, which can be especially attractive to young professionals or students.

- Storage: convert unused spaces, such as garages or basements, into storage units for additional income.

- Home Office Space: market your property to remote workers by offering a designated workspace and reliable Wi-Fi.

By getting creative with

your rental property, you can tap into new sources of income and adapt to changing economic conditions. Just be sure to check local laws and regulations before making any changes.

9. Get Creative With Marketing

By thinking outside the box with your marketing strategies, you can attract high-quality tenants, even in tough economic times. Here are some ways to stand out in a crowded market:

- Offer Virtual Tours: Give prospective tenants a 360-degree view of your property through a virtual tour or video.

- Host Online Events: From Q&A sessions to cooking classes, offering online events can be a fun way to engage with tenants and showcase your property.

- Partner With Local Businesses: If you have a few properties, team up with nearby shops or restaurants to offer discounts or special deals to your tenants.

- Social Media Marketing: Utilize social media platforms like Instagram and Facebook to showcase your property and interact with potential tenants.

- Referral Programs: Incentivize current tenants to refer their friends and family to your properties by offering a discount on rent or other perks.

10. Network With Other Landlords

Networking and joining landlord associations or attending networking events to learn new strategies for managing rental properties in a recession can be incredibly beneficial. It allows you to connect with other property owners and learn from their experiences, as well as gain access to resources and information that can help you better manage your own properties.

For example, you can join:

- San Antonio Real Estate Investors Association (SAREIA): This is a local chapter of the National Real Estate Investors Association (NREIA) and is dedicated to providing education, networking opportunities, and resources for real estate investors in the San Antonio area. SAREIA offers monthly meetings, workshops, and seminars on a variety of real estate topics.

- BiggerPockets: This is an online community and social network for real estate investors, landlords, and property managers. It offers a variety of resources, including forums, articles, podcasts, and a marketplace for real estate deals. BiggerPockets also has a local meetups section where members can connect and network with other real estate professionals in their area.

These are just a few examples, and there may be other local or regional groups or communities that rental property owners can join in San Antonio.

Managing rental properties

during a recession can be challenging, but it is not impossible. You can increase your chances of retaining tenants, reducing vacancies, and maintaining a steady stream of rental income by following the methods discussed above.

And if you're feeling overwhelmed, consider hiring a turnkey property manager like Bluebonnet to help take some of the weight off your shoulders. Contact them today for a free rental property assessment and see how they can assist you with managing your rental property during a recession.